Where to Now ?

Investors, founders and practically everyone else is wondering where the markets are headed

In between the many meetings last week in Toronto I did one workshop on valuation for an investor group and I also did my weekly graduate class ‘Financing the Venture’. During the conference and these sessions the one recurring question from founders was: how is the current market turmoil affecting our chances to raise investment? What will happen? It is not of course just a start-up question, more mature growth stage companies face the same question, as do investors in the public market arena. Everyone is struggling to make sense of what will happen next. So to give you some context, guidance if you like, here are some thoughts that can help, in random order:

Cleaning Out - The first thing that comes to mind is that much like the Internet Bubble of the 2000s we are witnessing a rapid retreat of investors and subsequent collapse of valuations. With that comes the inability of many of these companies to recapitalize and we are thus seeing bankruptcies and insolvencies across the board. The pain is felt in particular in the area of crypto, but also in B2B and B2C where the actual performance of companies combined with the market uncertainly no longer support lofty valuations. This is a re-set. It is good as it cuts the fluff out of the market and what is left standing is solid precisely because the survivors have real and working business models, generate cash, are mostly profitable and also have the wherewithal to raise on the back of those performances should they need to. In start-up land it means that companies built on weak economics and who raised initially on high valuations are in trouble. They either fall off the table or have to raise at much lower valuations, ie. the return of the infamous down-round. Again, it creates clarity for investors. It creates opportunities and destroys the crazy FOMO mentality that we have witnessed over the past few years where investors would stampede head over heels into overvalued deals with quite often questionable terms (SAFEs).

The Layoffs - many companies have started laying people off in order to preserve cash. Extending runway is key and the fat is almost always in staff and this where the cuts will inevitably land first. The over-hiring triggered by massive funding rounds is over. Back to core teams and reduced and highly flexible workforces. This has two positive effects: (1) a lot of people are now on the street who can be rehired by other firms who previously struggled to recruit in an overheated labour market; and (2) jobless people from tech in particular may consider their options and rather than return to work create new start-ups for themselves. People on the move create opportunity.

Back to Basics - as mentioned the focus is back on profitability, unit economics and a much tighter review of how sales and marketing dollars are spent to generate new revenue. Investors will no longer underwrite loss making ventures who keep spending to gain market share, in particular in a market where consumer spending is coming under pressure as interest rates go up (see below). We are going back to the simple notion of building profitable tech businesses that have sufficient capital to ride out the storm. Same happened in the early 2000s. It will not be the same for every business and industry, but consumer-hyped offerings (Peloton comes to mind) will struggle

Capital Availability - there is no shortage of capital. The number of funds raised by seed stage funds and VCs during the heydays of our most recent tech boom is not insignificant. It was often raised knowing that a downturn would come and to have dry powder ready for that moment. Capital however is currently sidelined, waiting for the right opportunities to emerge. Many investors will also take a break over summer and see how things shape up come fall season. The question is thus when funds really get deployed or as Wesley Chan of FPV Ventures said last week at the Collision conference: “who will catch the falling knife?” At some point investors will start biting the bullet and move forward.

Repricing the Asset - market turmoil is a messy process. Shares get oversold and then bounce back and this process repeats itself a few times until a new sort of equilibrium has been reached. What happens in public markets filters down to the startup market. As long as uncertainty over interest rates, bankruptcies and the fall-out of the Ukraine War continue, we will be in this mode and it is hard to see where asset prices will settle. Many argue that we are still in a market that is largely overvalued in particular if we are going to experience lower profits once the downturn starts to bite company earnings. My educated guess is that we will be in for some further gyrations this year and that the reduction in asset prices will continue well past summer into the fall. If you want to catch that knife if you think it is the right opportunity, great, but remember that the ‘big repricing’ is still in full swing.

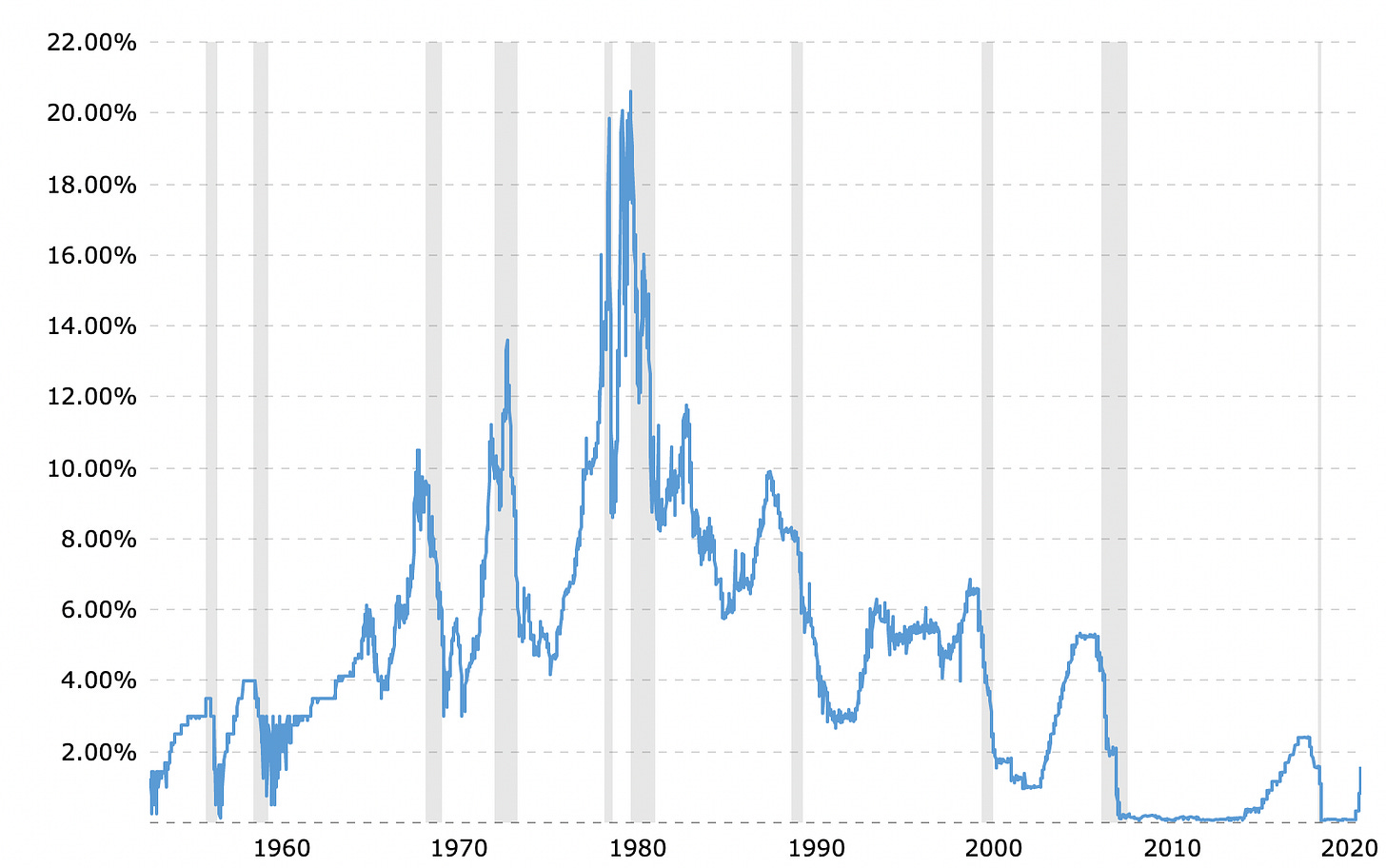

Interest Rates - the biggest impact is coming from interest rates. It means a few things. On the one hand investors will now start using different discount rates and this leads inevitably to lower valuations. It also points to other safer havens for cash that are now getting a much better return: the urgent need to buy equities has diminished considerably. And then there’s housing. The speculative housing bubble that has dominated almost the entire planet is now starting to pop a bit. Less borrowing to buy houses, less equity in homes to repurpose for renovations or consumer goods will really hit those economies that have flourished as real estate exploded: in particular Canada and the US.

Note the 62 year chart of the Federal Funds Rate, we are still in historically low interest rate territory as of today.

The Opportunity - the idea that tech is going into a cold winter of limited investment is insane. The need for and opportunities for continued innovation remain endless. I can show you two Vancouver-based companies that received crucial investment during the 2008 meltdown: Daiya Foods which got acquired a few years ago for US$320m (I declined to invest unfortunately, yes it happens) as was ClearVision in which I was a shareholder. These are two companies close to home that managed to capitalize during a brutal stockmarket downturn at quite reasonable terms. Since then we have become smarter and quite possibly more focused on the needs to create new tech, notably in areas where we are experiencing deep pain now: energy, food & agri, supply chain, cyber security and defence to name only a few. So it will be a lot harder for ‘dog walking apps’ and similar tech enabled start-ups to raise funds now. The smart money is on deep tech, but there are some who will argue that digitization of traditional industries is still ongoing and far from complete.

The Big Uncertain - the question emerges however is when did we see a combination of what we are seeing now? Inflation and rising interest rates, war, robust tech and contraction on the consumer side and the after-effects of a worldwide pandemic, all at the same time? The answer of course is that we have not. The 2000 meltdown merged into the post 9/11 rate cuts and what I call the mobile revolution coincided with the aggressive post 2008 rate cuts. We are now in uncharted territory. There are consequently no real theories with predictive value that can help you wade through the current crisis. You have to piece together your own reality and navigate it.

So?

There is no easy answer. But I tell myself and the many entrepreneurs who raise the issue that out of every crisis come opportunities. Strong companies will adjust, adapt and move on to new heights. New companies get started. Yes: valuations come down, quite a bit and investors will take longer simply by sitting on the sidelines. A lot of investment will also be directed to support existing companies to the detriment of newer ones (I see this happening in the portfolio of our fund). This is a totally justifiable and sane approach, back up what you have so they can survive and thrive.

So the advice is to work with what you have, keep going irrespective of short-term fluctuations because the long term outcome is far more important than the short term inconveniences (hard to raise money, accept lower valuations, cut costs etc. etc.). I have given you some context on what came before us, what is happening now and you should use this as some high level guidance to find a possible solution, whether you are an investor in the private and public markets or an entrepreneur. As Churchill said, “if you’re going through hell, keep going”. That really is the best thing you could probably do now. And that is what investors and founders have always done.

Very smart guy, in my opinion!