Welcome to the already fourth edition of the Mid-Week updates, the weather here is still nice and warm, the photo above was taken on the daily morning walk.

Israeli Elections

Four weeks from now Israel will be going into its fifth election in three years. Yes, proportional representation is great but with a fractured parliament it is generally bad news. The election, like the last one, will focus on the one man who has been dominating Israeli politics for a number of decades and that is Benjamin ‘Bibi’ Nethanyahu. An ‘anything-but-Bibi’ coalition (comprising left, right, center and Arab parties) managed Israel for a little over a year. It was able to make progress in a number of areas where previous governments had neglected to act. However a steady breakdown of public order in particular in the West Bank (where Israel works together with Palestinian Security officials) is creating an unstable and violent situation not seen in many years. This will provide the opening to Nethanyahu whose skillset in keeping Israel safe will be his trump (no pun intended) card to come back and the poll numbers appear to favour him, albeit marginally. I will be watching closely, also because a trip to Israel is lined up for early next year (can’t wait).

The deal is back on … that is Musk’s offer to buy Twitter at $44 billion. It was eerily quiet around the whole transaction that I wrote about earlier. The reason for this was probably that Musk’s lawyers and accountants were working behind the scenes and concluded there was no way Musk could argue he had grounds to back out of the transaction. This plan would flounder in front of any judge. Of course Twitter’s stock surged yesterday and those trading the stock through the recent uncertainty will have enjoyed the ride. But the real attention on the platform itself this week went to Musk when he waded into the war in Ukraine and put up some suggestions around Ukraine’s neutrality and cutting a deal with Russia. It was not all that well received and one of Ukraine’s top diplomats put it succinctly back to Twitter’s new owner:

As I have said before, Twitter’s gyrations will impact Tesla shareholders one way or the other. Enjoy the ride, it is only just getting started.

Markets

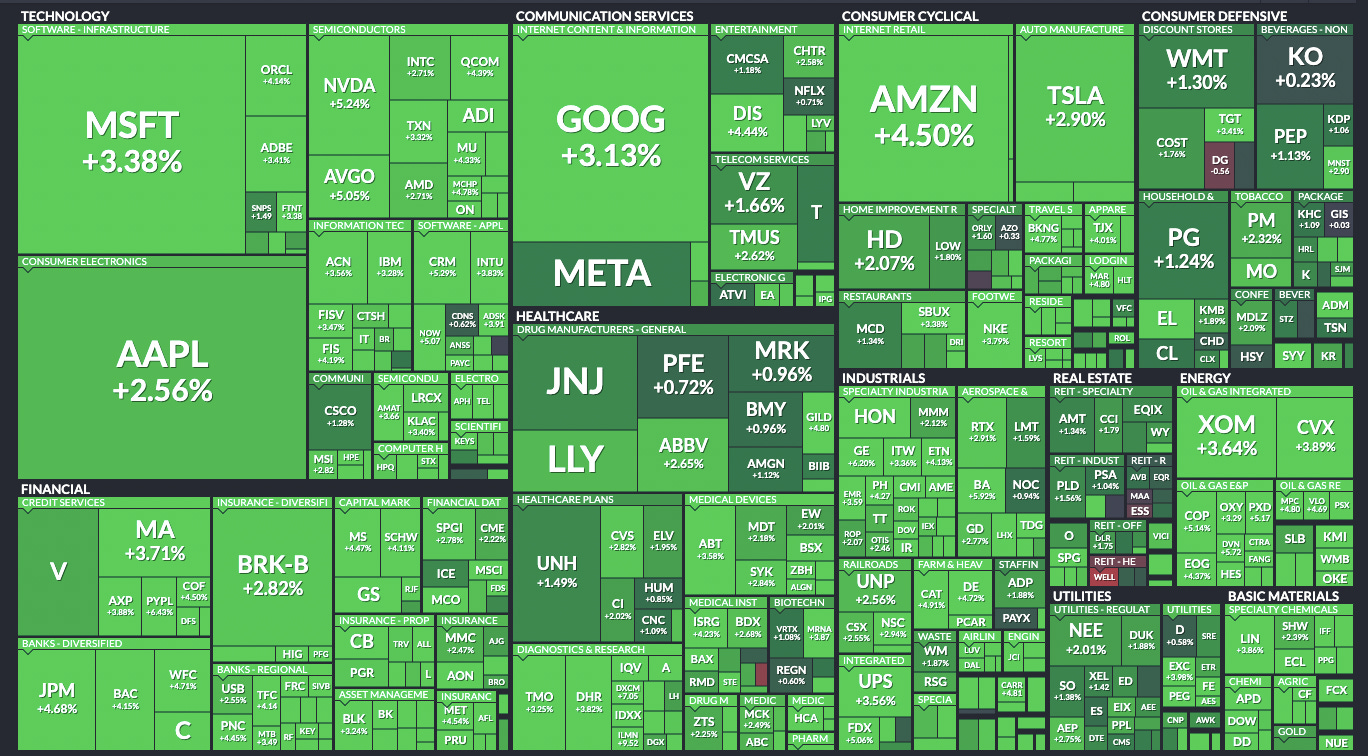

The tail end of Q3 saw the markets being oversold and I never doubted that there would be a bounce back this quarter. Although economic news remains mixed with continued high inflation numbers, we may be seeing a turn on an overly hard stance on interest rates. While Australia raised its rates yesterday, it did so by a smaller than expected increase and that could be a sign that the pace of monetary clampdown may start to ease a bit. I remain careful, the markets are jittery, but it was nice to see this yesterday:

Dutch Farmers

You will remember my longer piece on the Dutch farmers revolting against the government’s plans to aggressively cut nitrogen emissions by 2030. Protests got out of hand with police officers even opening fire on some farmers and I wondered where the Dutch skill for finding the middle ground had gone. A report from the mediator has come out today and the early indications are that while the 2030 emission targets remain in place there will be less pressure on the farmers to take the involuntary lead on paying the economic price for this. There was also criticism on how the government had handled the file so far. That said, 500-600 farms are earmarked for a buy-out within one year. We’ll see where it ends up, but it may well reflect the old Dutch saying that ‘the soup is never eaten as hot as it is served’.

Your Weekly Truss

It was never my plan to cover Liz Truss on a weekly basis, her emergence a few weeks ago was just a newsworthy item. But the political chaos unfolding in the United Kingdom right now is instructive on many levels and warrants real attention. Following Liz Truss and Kwasi Kwarteng’s announcement to drastically cut taxes a storm of outrage followed, the pound dropped in value, the Bank of England stepped in and even the IMF got into the debate. If that were not enough, domestically the first rumblings in Truss’ own party started to come to the surface and polling numbers indicate Labour would destroy the Conservatives if an election were held today. Her leadership position, barely a few weeks old, became unstable overnight.

But the real question surrounding Truss and her party is how they could have gambled away the phenomenal support that Boris Johnson garnered during the 2019 election. It was a masterstroke to capture the working class vote with a less market focused and more caring definition of what conservatism could look like in the new century. American-British commentator Andrew Sullivan wonders and explains it in his newsletter and it does raise the question if Boris was not ditched too expeditiously. It will serve both left and right parties to study the case of the British Conservatives in a world where the once so popular market-driven policies have outlived their usefulness. I have made the point before on how the failure of neo-liberalism to create access to wealth for all is affecting the traditional left-of-center parties chances of success. It would be foolish for the right to double down on similar outdated approaches.

Interesting to see tech share prices firming up a bit. What 12 Month Forward ARR multiples are you seeing on valuations (I know this is a silly way to value a company but that does not stop people from doing it). I was doing an ROI calculation on some pricing work that we are proposing and used 5X. The CEO bristled and thought this should be higher, I was actually thinking more like 3X for private companies in the current market.

In Canada, do we have politicians going down the same path as Truss?