Thanks for checking in this week, it has been an unusual one with lots going on and I timed the updates with the hostage releases in mind. I will continue to cover these but will also try and circle back to the larger themes like global trends and assess how international politics impact the economy (see below). That said, the hostages have always been pawns in a larger international power game, fought out in Washington, Qatar, Jerusalem and Cairo to name only a few capitals. Their fate was sealed well before October 7th. That day of horror and hostage taking only brought out the underlying trends into the open for everyone to see clearly and I hope that my updates contribute to that. The perpetually shifting alliances and power dynamics in the Middle East accelerated and with Trump’s arrival on the scene we can expect more of the unexpected.

It is therefore doubly tragic to see how innocent bystanders get to suffer the most. And their dignity is being stripped away right before our eyes, deliberately. That is why we are in tears because we actually believed we should not ever have to see it again. I opened yesterday with the Arbel Yehud video and I did that because people needed to see what she looked like after 482 days of isolation and abuse and what was done to her in the last moments of her captivity. Most of you my dear readers get it, but much of the world doesn’t. Imagery like this can help make some important arguments and hopefully shift the narratives propagated in western media.

It was signalling to the world that no matter how many hostages get out alive and Israel rejoices, Hamas is managing very hard to turn it all to its own advantage with all its regional and global consequences. With imagery today, with more violence soon.

Finding the words to describe the damage inflicted on Arbel in this process is hard. The images have grieved her family to the point that yesterday they requested - through Hen Mazzig - that the video be taken down. So I have removed it from yesterday’s post and my Facebook update where I also used it. We have to respect that but at the same time never forget these images, they are the reminder of what is at stake and that another escalation where these innocents are the target again is right around the corner.

Now on to other things …

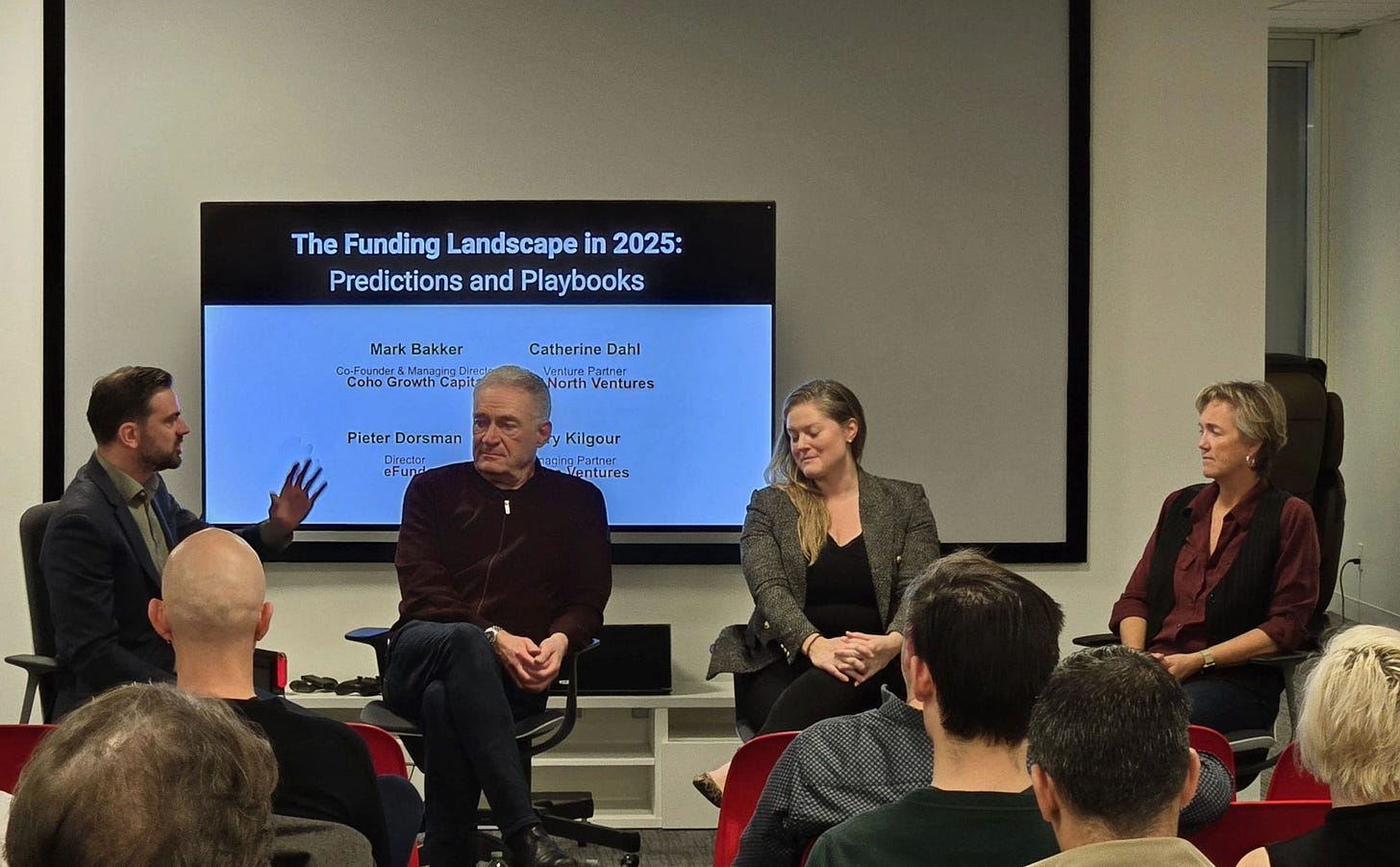

It has been a while since I last talked about the world economy, the investment climate and in which direction we are going. On Wednesday evening I had the honour to elaborate on that at a panel for the start-up community here in Vancouver, organized by William Johnson. The core question was how the new year is shaping up for investments in early stage companies, but in discussing that we are getting a good view of investment and economic trends at large.

My basic argument was that ‘tech’ has grown and boomed over the past 20 or so years thanks primarily to extremely low interest rates, generous monetary policies and political stability. Cheap money helped transform our economy. The financial crisis of 2008 was a definite shock, but it ensured that long term conditions for investment given the low rate environment continued. Now, that crisis also seeded the trends of increasing the cost of housing and attendant affordability issues which in turn gave wings to the emerging populist movements around the world. The latter was a process that got going in 2016 with Brexit and Trump’s first election as president and has increased in intensity over recent years. Look also at Europe and the economic and financial turbulence there, elections in Germany next month are expected to upset the existing order and recalibrate things there.

Still, the pandemic kept the money flowing in the 2020-22 period and those years where everyone was sitting and trading at home became a sort of the golden age of early stage tech investing. It turned out to be a peak and we are in some sort of correction territory. Why?

During the panel I said that we are still in a relatively high interest rate environment compared to the last decade and political instability is increasing everywhere you look. Combined these trends and you will see the opposite of the first two decades of the century and they give you exactly that what investors don’t like and it is called uncertainty. The tariff threats from Trump are not exactly helping to put it mildly.

So that is why gold and Bitcoin have become safe havens with both reaching record levels. Staying in cash is of course the other bet but not necessarily a great one given the inflationary trends all around us. And yes, big tech like Nvidia, Meta, Apple and Tesla have outperformed almost all other assets and so that is where most of the action has been to the detriment of riskier investments in new technologies. We will have to see where the confluence of politics and finance will take us next, but I am pretty sure it is wild terrain. Buckle up.

Photo by Prashant Agrawal

Hartelijk dank, Pieter! Je hebt er een vaste lezer bij. Waardevolle bespiegelingen, informatie en analyse ineen. Shabbat Shalom! Bas